When Will the Santa Rally Start?

Last week was rough for equity markets. The S&P 500 Index fell 3.4%. As we noted, December is historically strong for stocks, and we don’t expect 2022 to be any different. It has been the third best month for the S&P 500 since 1950 (April and November are stronger) and third best during a midterm election year (October and November typically perform better).

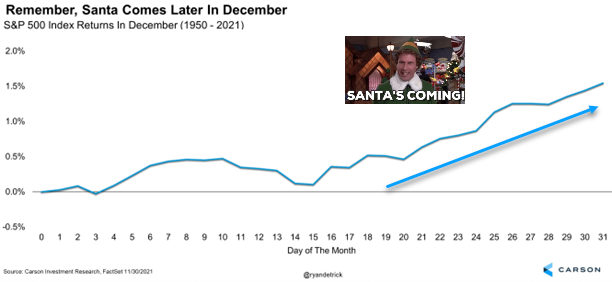

But what’s in store for the rest of the month? One of the most well-known investment axioms is the “Santa Claus rally” and most investors assume it means stocks do well the whole of December. But that’s not the case. Most of the strength in December happens during the latter half of the month. It makes sense to me — that’s when Santa arrives!

- Equity markets had a tough start to the month, but Santa comes later in December.

- Expect the Federal Reserve to increase interest rates by 0.5% this week to a 4.25-4.5% range.

- How high do Fed officials think rates should go for inflation to be curbed?

- Easing gas prices should put more downward pressure on inflation.

- Private measures suggest goods prices and rents will fall, but it will take time.

After the huge rally off the mid-October lows, some consolidation is perfectly normal. But after stocks catch their breath, we think a strong year-end rally is quite possible in 2022.

The big focus this week will be the Federal Reserve’s meeting. It’s widely expected, including by us, that Fed officials will raise interest rates by 0.5%. That’s a step down from the 0.75% hike during the last four meetings. However, the key takeaway will be their summary of economic projections, which will tell us how high they think they must go to control inflation. At their September meeting, the median official thought rates would end up at 4.6% (they’re currently at 3.75-4%). They’ve since suggested in speeches that this may have to be higher, and markets are expecting them to approach 5%. So, it won’t be a complete surprise if the median rate increases. We suspect they’ll continue telling us they will be “data-dependent,” and there’s positive news on that front.

Good News on Inflation: Falling Gas Prices

Inflation has been on many minds this year, including families, investors, and Fed officials. Surging inflation has weighed on consumer sentiment, although arguably this is mostly because of gas prices. As gas prices fell after the summer, consumer confidence started moving higher once again.

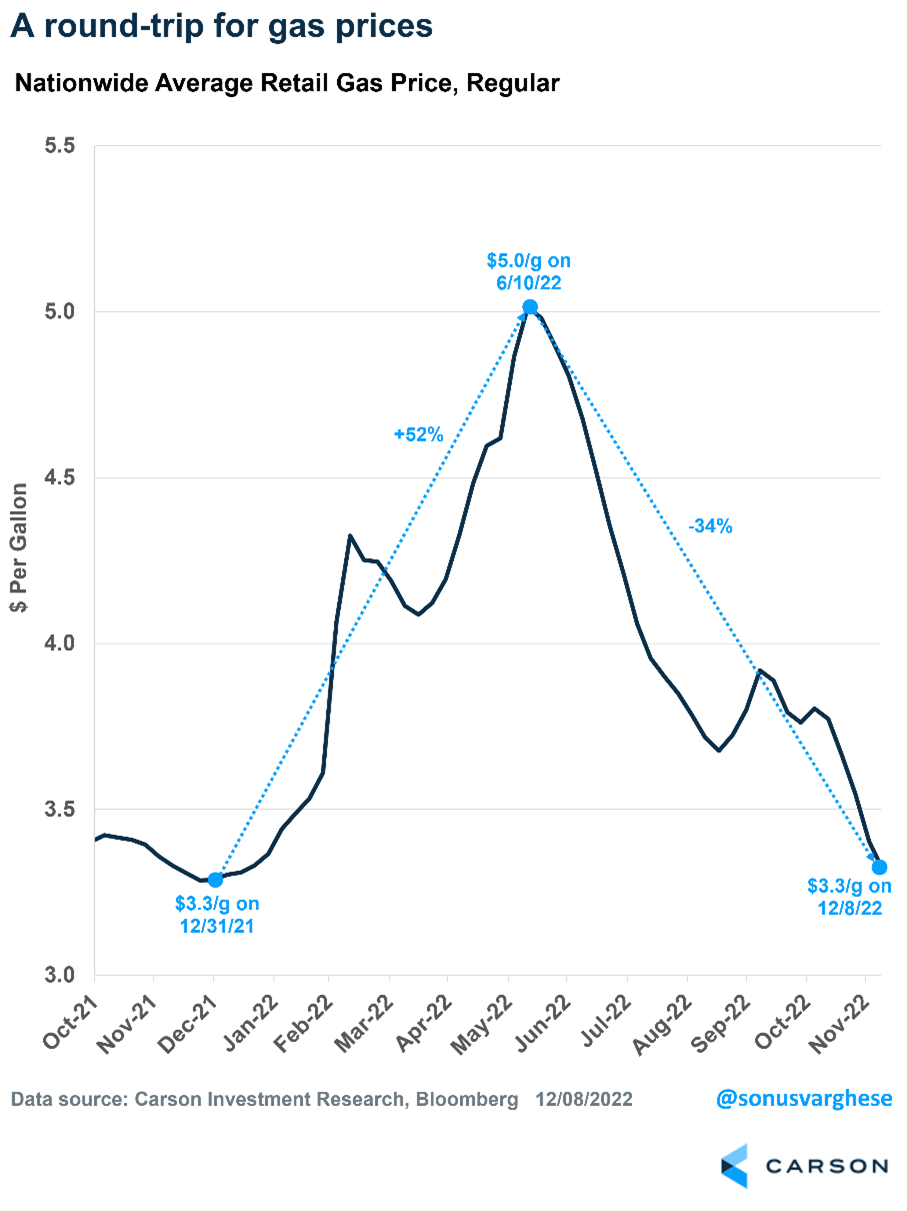

Gas prices ticked up slightly in October, but the good news is nationwide average gas prices have almost entirely erased the surge from earlier this year. Gas prices are now back to where they started the year, at approximately $3.30 per gallon. As the chart illustrates, gas prices rose 52% through June and then collapsed by 34%, taking them back to the starting point.

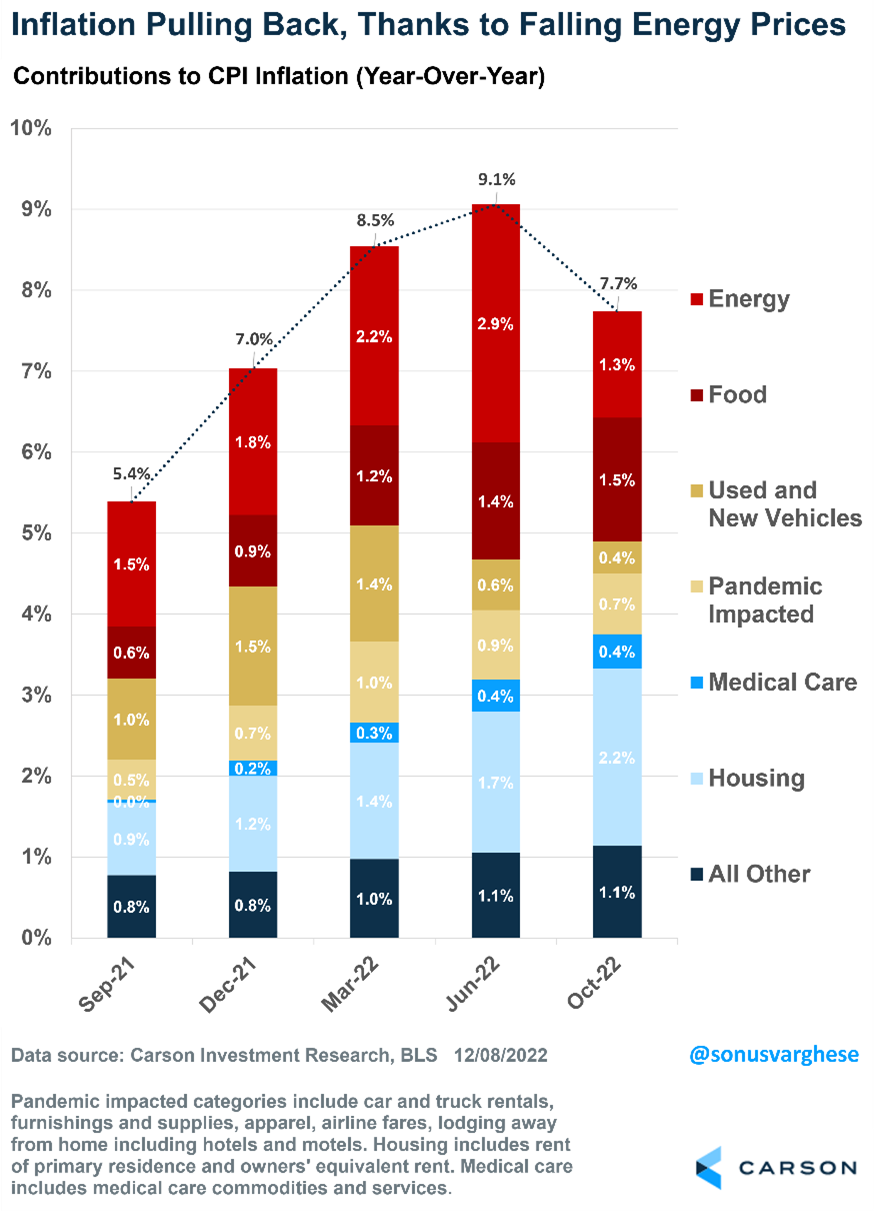

This is great news. As the chart below shows, inflation surged in the first six months of 2022 on the back of rising energy prices. By June, the year-over-year increase in energy prices accounted for about one-third of the 9% headline CPI inflation. However, energy prices (mostly gas prices) have pulled back since June and that’s helped inflation to pull back. This is despite other factors, such as housing, which continue to put upward pressure on inflation.

The above data is correct through October, which is encouraging because gas prices have fallen since then. So the November data, which will be released this week, should show energy prices continuing to pull inflation lower. In fact, if gas prices stay at this point for another couple of months, the light red bar in the previous chart (representing energy prices) should go below the zero line. In other words, energy prices would be a deflationary force on inflation.

This matters for monetary policy. The Fed’s ultimate inflation mandate is to keep headline inflation stable. Fed officials only focus on “core” inflation, which excludes food and energy, because that is less volatile and a better predictor of future inflation. Falling gas prices will ease headline pressure over the next couple of months. That in turn should ease pressure on the Fed. Any pullback in inflation essentially buys time for core inflation components, such as goods prices and housing, to start falling. And there’s positive news on that front as well.

More Positive Signs for Inflation

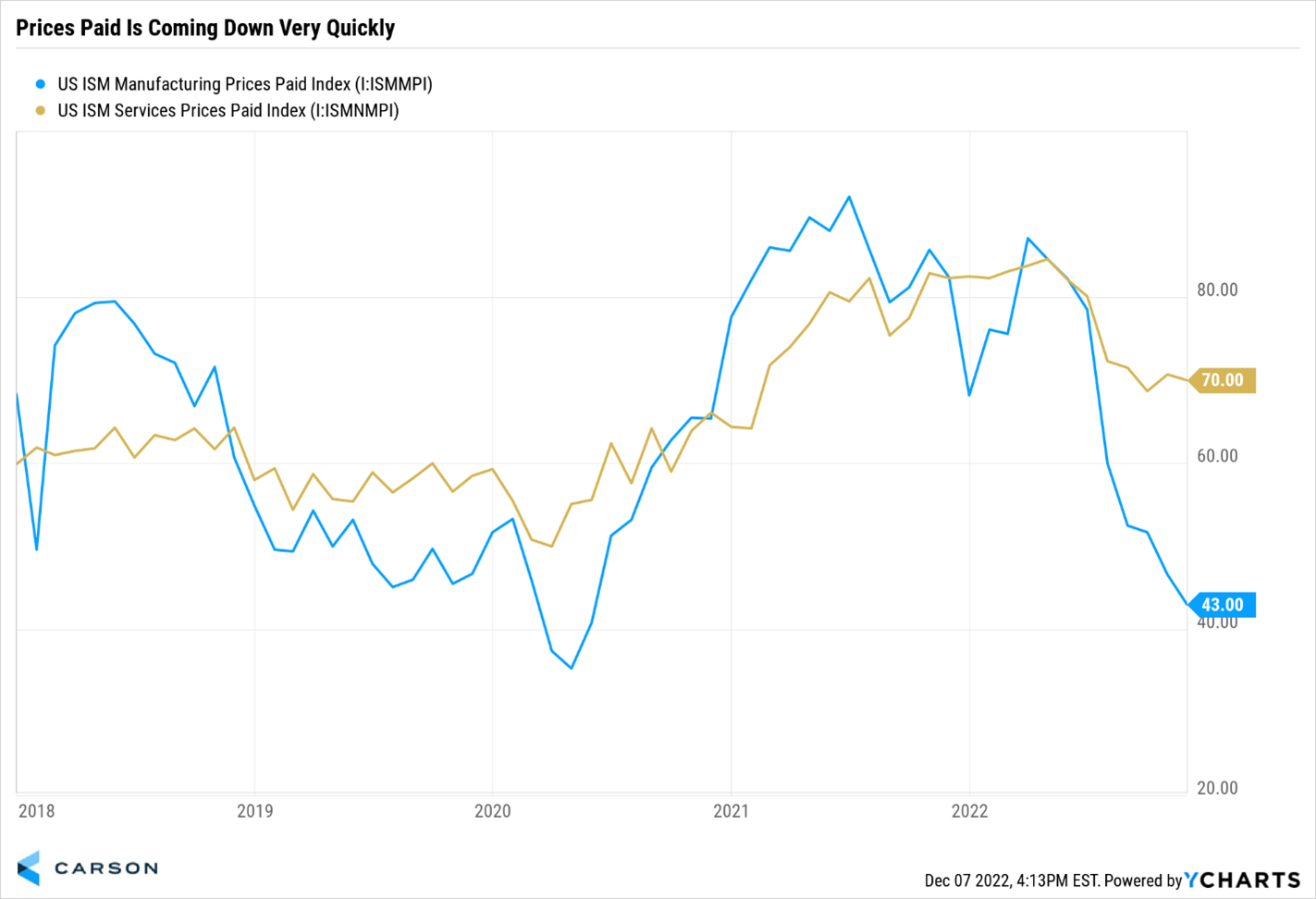

Prices paid for manufacturing have crashed. If people aren’t paying as much for stuff, there’s a good chance companies will charge less for it. As the chart below shows, manufacturing is dropping at a record pace, although services prices have been more stubborn. In fact, manufacturing recently came in at 43, which is cut in half from March and indicates prices are falling now (since it’s below 50).

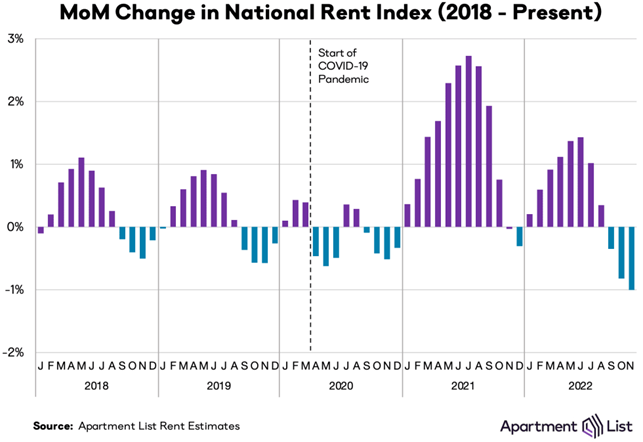

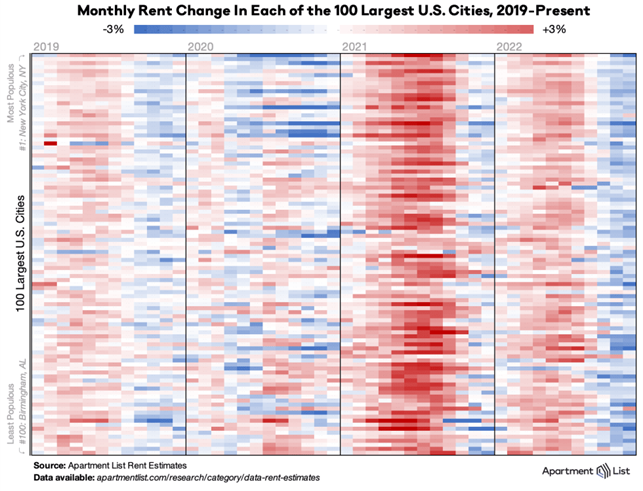

Shelter makes up about 40% of the core inflation basket, so it’s a very big deal when it runs hot like it has for most of 2022. But should it turn lower it will a nice tailwind. Although the government’s data showed rental prices were recently up more than 7%, private measures of rents have slowed considerably. The Apartment List national rent report fell a record 1% last month on the heels of the previous record of -0.8% set the month before.

Apartment List found that rents were up 17.6% last year. But they are up only 4.7% this year and the trend remains firmly lower. Rents in 93 out of the 100 largest cities saw rents decline last month, so it’s safe to say this is a widespread trend.

Once again, the government data lags the private data. But the government looks at both existing and new leases, while private indices consider just new leases. Also, for the official data, rental units are sampled only every six months (since rents aren’t renegotiated very often). For this reason, we expect CPI rental measurements to lag private indices by about 8-12 months.

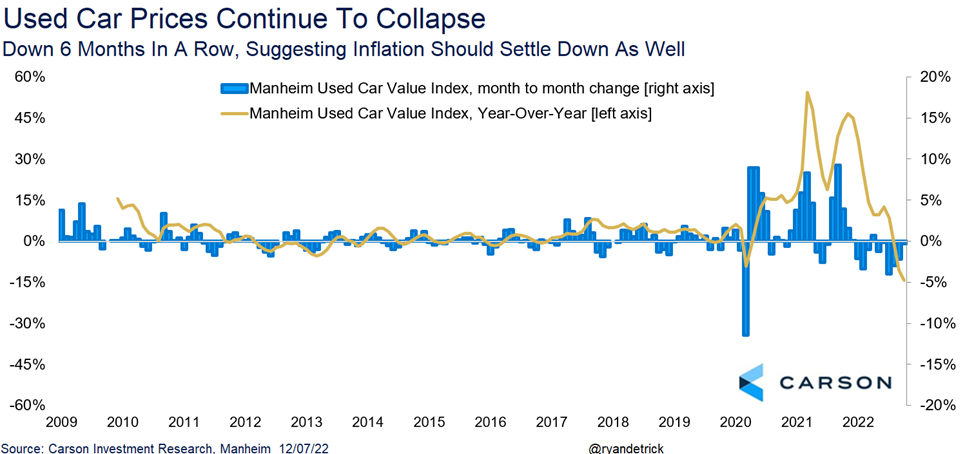

Finally, used car prices continue to sink. The Manheim Used Car Index showed used car prices have dropped a record six months in a row and are down year-over-year 14.2%, the largest decline ever, according to their data. Since used cars make up about 5% of headline inflation, this is another potential tailwind as we head into 2023. Similar to rent prices, the government’s data tends to be slow, so we expect these lower used car prices to factor in more over the coming months.

Why does all of this matter? As quickly as inflation soared, we think it could come back down in 2023. Rents, prices paid, and used cars all suggest much lower prices could be coming soon. This of course would give the Fed room to take the foot off the pedal and likely end rate hikes early next year.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case # 01585010