Welcome to December

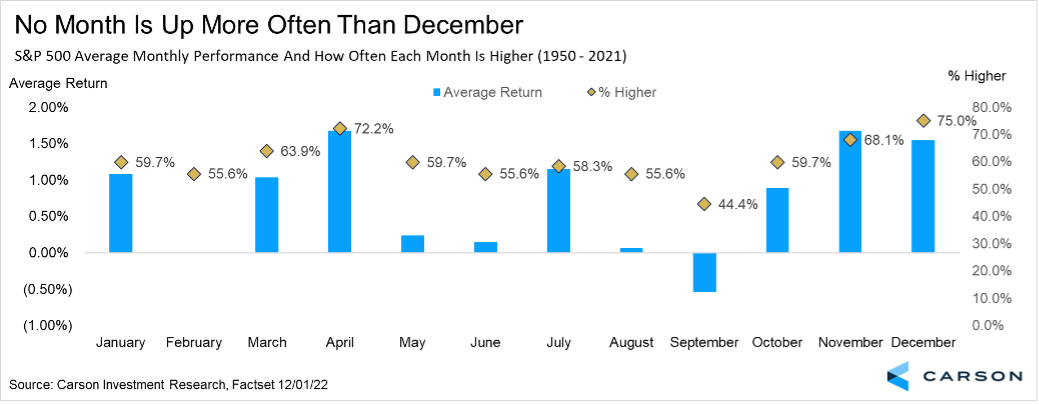

Can you believe we’ve made it to the final month of the year? Stocks gained nicely in October and November (more on that below), but now we head into the jolliest month of them all. The good news is no month is more likely to be higher for stocks. The S&P 500 has been up 75% of the time in December since 1950. Stocks have gained 1.5% on average this month, with only April and November faring better.

- November was another big month for stocks, making it two months in a row of solid gains.

- December is typically positive for stocks.

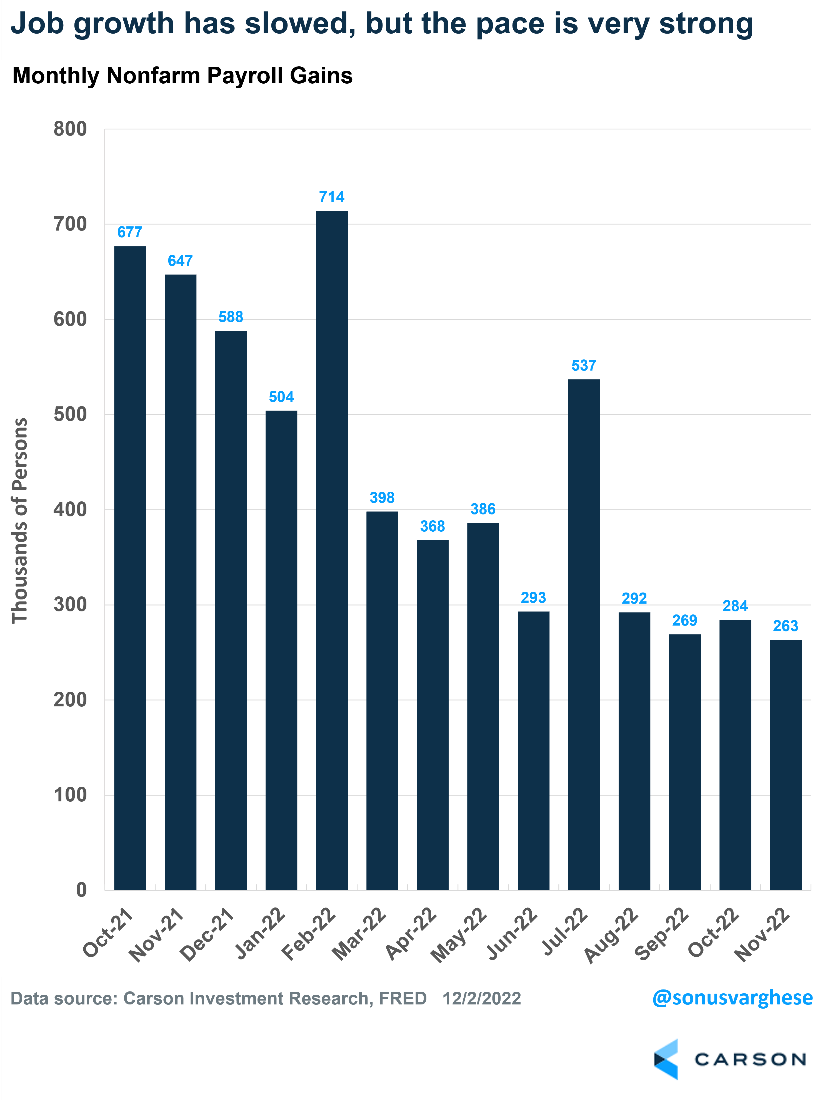

- The economy looks strong. Payrolls grew 263,000 in November and the unemployment rate stayed low at 3.7%.

- Consumption is accelerating on the back of rising real incomes.

- The Fed looks set to slow the pace of rate hikes, buying time for inflation to ease further.

After the big rally off the mid-October lows, some type of consolidation or modest breather would be perfectly normal early in December, but we expect the recent strength to continue. Some market analysts are calling this a ‘bear market rally,’ similar to the 17% rally over the summer. Bear market rallies are periods when stocks bounce well only to move back to new lows. But there are several differences: many more stocks are participating in this rally; many other sectors are participating, suggesting the underpinnings are stronger now; and August and September are historically two of the worst months of the year (especially in a midterm election year), while the coming months and quarters are seasonally quite strong.

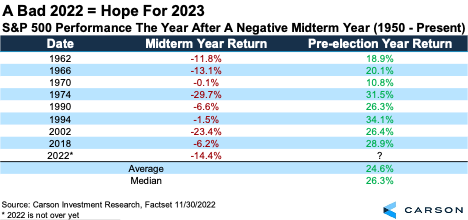

Historically, midterm election years are the worst for stocks out of the four-year presidential cycle, but the good news is the best year is the following one, the pre-election year. Looking at the past eight times a midterm year was lower, the following year was higher every single time, up 24.6% on average. This could have bulls smiling in 2023 should history repeat.

One More Good Sign

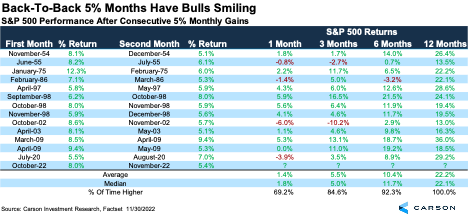

As mentioned above, many investors think this is a bear market rally and eventual new lows are coming for stocks, but we disagree. Here’s the best way to show this. The S&P 500 soared 8.0% in October off the bear market lows, but it then added another 5.4% in November. This back-to-back 5% monthly gain is extremely rare and a sign of strength, consistent with previous bear market lows. This occurred in the summer of 2020 and the periods following the bear market lows in 2003 and 2009. Those weren’t the worst times to be on the lookout for improvement.

The chart below shows all times the S&P 500 has had back-to-back 5% monthly gains. The future returns are quite strong, with the average return a year later up 22.2% on average and higher 13 out of 13 times.

Don’t Count This Economy Out

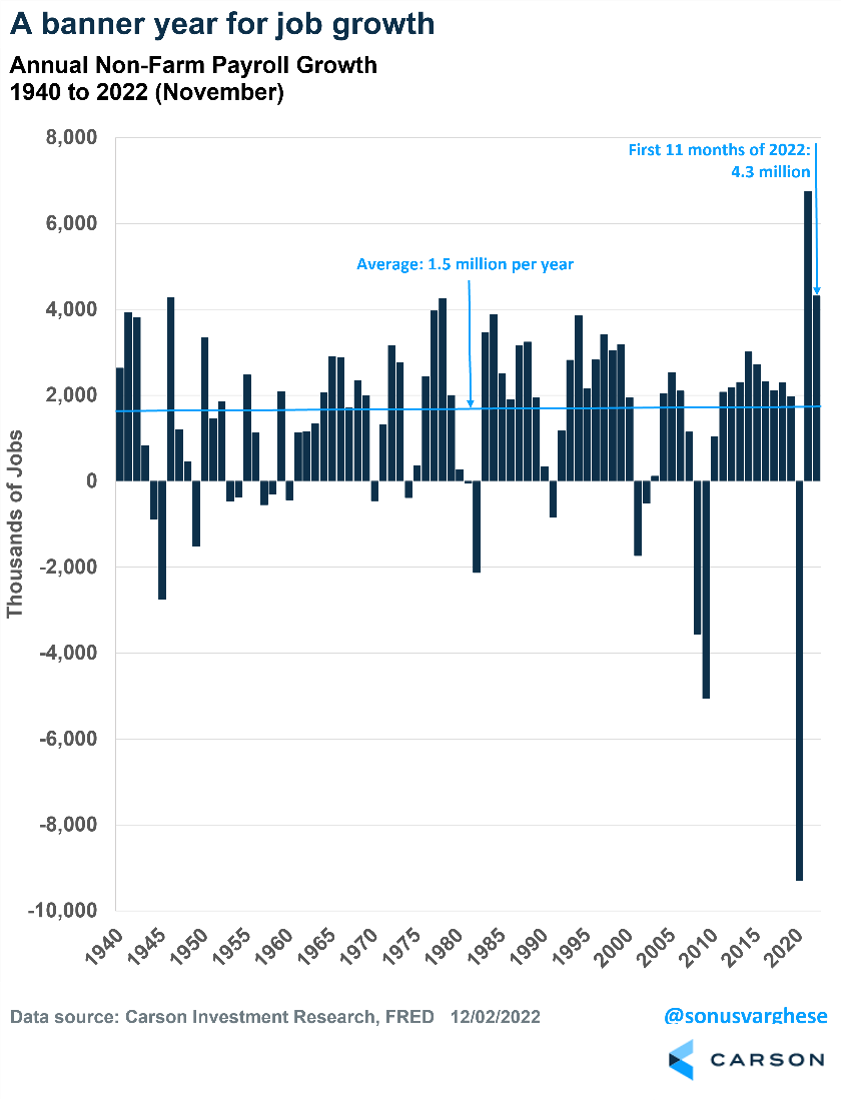

The big headline for the November payroll report was that 263,000 jobs were created last month, well above expectations of 200,000. Job growth has slowed since the beginning of the year, but make no mistake, this is still a very strong pace of job growth. As Fed Chair Jerome Powell noted in his recent comments, Fed members think monthly job gains of 100,000 are required to keep up with population growth. We’ve been well above that recently.

Overall job growth in 2022 totaled a whopping 4.3 million, putting it in line for the second-best year for job creation in 83 years (only last year was better). Also, the unemployment rate is currently at 3.7%, which is close to a record low.

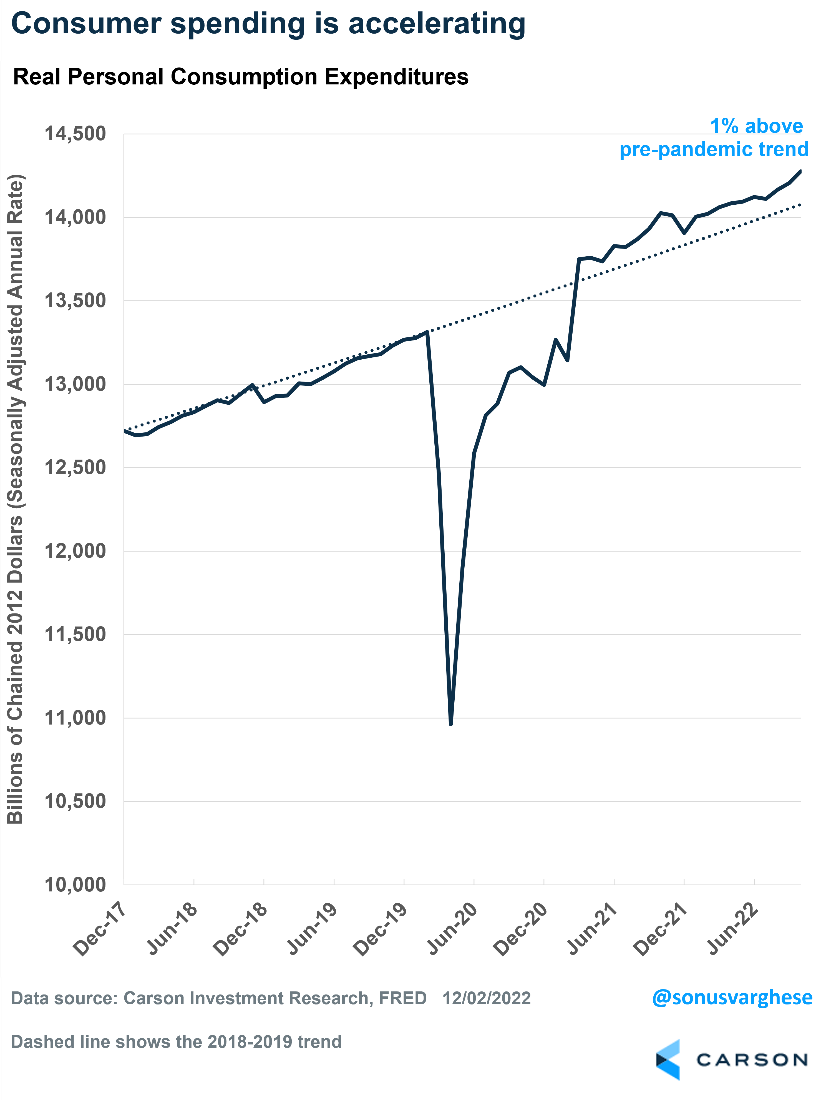

It should not be a surprise that consumption is strong. Real personal consumption, i.e., after adjusting for prices, is accelerating once again. Much is on the back of vehicle sales, which are rebounding as production recovers. Keep in mind that consumption makes up about 70% of the economy.

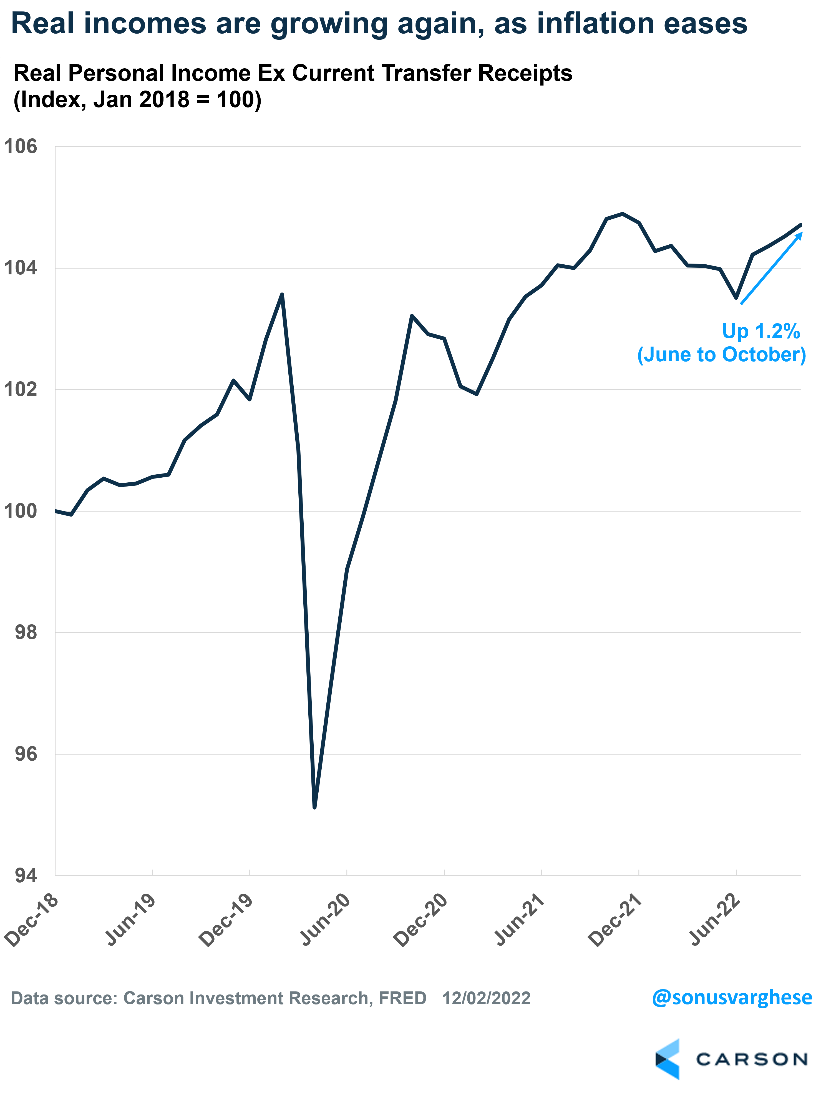

The biggest reason for accelerating consumption is incomes are rising again after adjusting for prices. Real personal incomes have increased by 1.2% over the five months through October.

In short, inflation is easing, meaning incomes are rising on a real basis, allowing consumers to spend more — and they are. We believe this will continue into 2023 as inflation pulls back even more. Note that consumers still have excess savings from the pandemic. They’ve pulled about $1 trillion out of it over the last year, but that still leaves more than $1 trillion left over.

None of this is what you would expect if the economy is, or was, close to a recession.

Is There Anything to Worry About?

Yes, there is — the Federal Reserve.

Fed Chair Jerome Powell made important comments in his speech last Wednesday. The headline was that the Fed is going to ease the pace of rate hikes, which is welcome news. Also positive was the fact that the Fed was encouraged by the pullback in goods inflation. Powell also acknowledged that official rental inflation lags the sharp deceleration in rents that we see in private data (see our prior writing on this here and here).

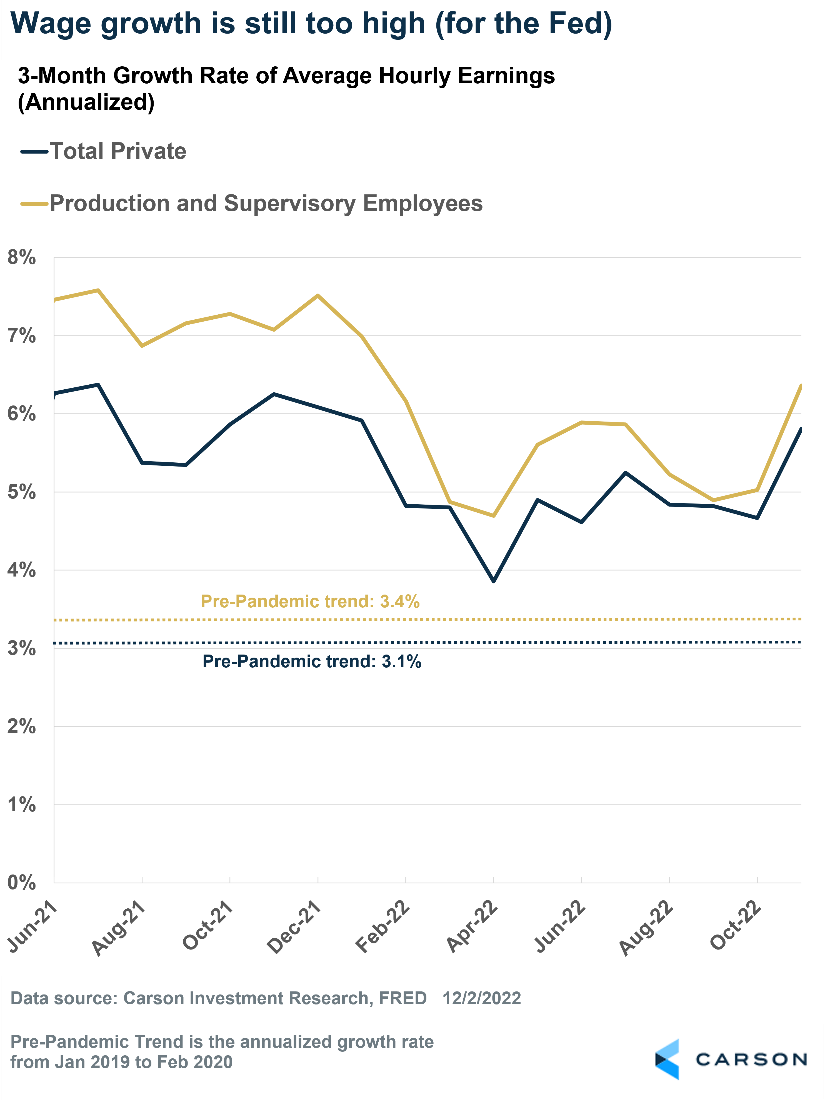

However, the Fed is still worried about everything else, i.e., services inflation outside of housing, such as medical care, personal care services, insurance, financial services, education, childcare, etc. These make up about half of core inflation (ex-food and energy). While these categories did see a pullback in October, that’s just one month. The key is that Powell and the Fed believe these will ultimately be dependent on the labor market, especially wage growth.

The November payroll report did not have great news concerning this. Wage growth accelerated, rising 0.6% for all private workers (versus the expected 0.3%) and 0.7% for non-managerial employees, who tend to spend relatively more of their incomes. On a three-month basis, hourly wages are running at an annualized pace of 5.8% for all private workers and 6.4% for non-managerial workers. These are well above pre-pandemic averages, which is probably where the Fed would like it to be.

Wage growth by itself is a good thing. But the Fed believes stronger wage growth will keep upward pressure on inflation. Color us a little skeptical about this, especially given all the other data we’re seeing. But it doesn’t matter what we think. We need to follow the Fed’s framework, which means there is still a risk that the Fed overtightens and pushes the economy into a recession.

Our base case is the economy is strong enough to handle the aggressive rate hikes for now. All the data that came out this week confirms that likelihood. Plus, it looks like the Fed is going to slow down the pace of rate increases. This is important because it buys time for inflation to ease even more, hopefully convincing the Fed to back off in early 2023. And as we discussed at the top, markets may be sniffing out this bullish possibility.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case # 01575165