Market volatility surged last week, although the end result for the S&P 500 was a decline of only 0.2%. Central banks were the main culprits for the volatility. On Wednesday, the Federal Reserve announced it would raise rates 0.5% and clarified plans on how it will shrink its balance sheet. In the subsequent press conference, Fed Chair Jay Powell announced there are no plans for rate increases of 0.75% in a single meeting. Those comments contributed to a sharp rally in the S&P 500, which increased almost 3% on Wednesday.

Key Points for the Week

- Stocks surged and sagged after interest rate hikes and comments from the U.S. and U.K. central banks produced far different market reactions.

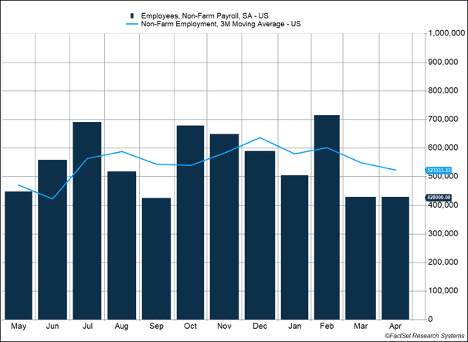

- The U.S. economy produced 428,000 jobs in April, beating expectations and reassuring investors the economy remains relatively strong. Unemployment held steady at 3.6% and labor force participation dropped 0.2%.

- Demand for labor remains robust as job openings and quits set record highs in March.

Thursday produced the opposite reaction. The Bank of England increased its key short-term rate to 1% from 0.75%, the fourth straight increase of 0.25%. The increase was smaller than expected and reflected the BOE’s expectation that British economic growth will slow throughout the year and ultimately contract in the fourth quarter. The BOE forecast anemic growth in 2023. The BOE also forecast inflation to move above 10% and suggested little can be done about it. The dour forecast and expectation of an economic decline were the equivalent of a central bank throwing in the towel. The S&P 500 dropped 3.6% on Thursday in response.

The U.S. also released a series of key jobs reports last week. The big news is the economy produced 428,000 jobs, according to the establishment survey (Figure 1). That beat expectations and indicates the economy continues to reclaim jobs lost during the pandemic. Unemployment held steady at 3.6%. A 0.2% decline in labor force participation raised concerns the supply of labor won’t expand to meet demand and wages could accelerate, contributing to inflation. Last month, wages rose 0.3%, which is a decline from prior reports. Labor demand remains robust. The March Job Openings and Labor Turnover Survey (JOLTS) indicated 11.5 million jobs remain unfilled and 4.5 million people quit their jobs last month. Both measures were record highs and suggest the economy can weather some of the planned rate hikes.

Last week, the S&P 500 edged down 0.2%. The global MSCI ACWI slid 1.2% as European and Chinese stocks lagged. The Bloomberg U.S. Aggregate Bond Index declined 1.1% because long-term interest rates moved higher in response to the Fed scaling back rate hike expectations. The U.S. Consumer Price Index will be closely watched this week for signs of any change in inflation trends.

Figure 1

Bond Volatility

Many of us who watch markets on a daily basis felt pretty good after Fed Chair Jerome Powell wrapped up his press conference on Wednesday afternoon. The Fed did what was expected and raised interest rates 0.5%. It announced plans to shrink its balance sheet by $47.5 billion per month for three months and then double that amount thereafter.

The Federal Reserve is raising interest rates to try to slow inflation. Usually, the Fed moves 0.25% at a time, and this was the first 0.5% increase in 20 years. The faster-than-normal increase was designed to show the Fed is taking the inflation threat seriously.

Even though rates were moved higher, the Fed made reassuring comments that caused investors to send stock prices sharply higher:

- There are no plans to raise rates by 0.75% based on the current environment, which reduces the risk the Fed will raise rates too fast and push the economy into a recession.

- The Fed’s plan to reduce its balance sheet is faster than expected and was viewed positively as a way to reduce inflation without having to raise interest rates too quickly.

- Powell stated the Fed is looking to raise rates when inflation is controlled, rather than raise them past neutral and force a recession to remove inflationary pressures.

- The Fed remains confident it can engineer a “soft or softish landing,” meaning the economy would slow and avoid a severe recession.

- The vote was unanimous.

In short, Powell’s press conference showed a united Fed cares about its core objective, provided clarity on the direction of policy, and displayed conviction it will work.

The Bank of England’s announcement the next day lacked these characteristics. The BOE raised rates 0.25%, which means rates are now at 1%. That part was expected. But the comments of Governor Andrew Bailey and the monetary policy report indicated a much dourer outlook than expected. Governor Bailey expects inflation to rise to around 10% this year and the economy to slow and even contract in the fourth quarter. The BOE offered no concrete plans to shrink its balance sheets, putting that decision off to the early fall. Three members voted against the move, as they favored a 0.5% increase in rates.

That a central bank head would do the equivalent of throwing in the towel is hard to imagine. Central banks are often too optimistic of what they can accomplish. Yet, Governor Bailey essentially said England will be entering a year-plus period of stagflation and there is little they can do about it. The pessimistic outlook from the BOE helped precipitate a more than 3% decline in the S&P 500 on Thursday.

Both central bank heads face difficult circumstances. Russia’s invasion of Ukraine pushed oil prices higher and contributed to a surge in energy prices. China’s lockdowns mean supply chains won’t heal as quickly as they would otherwise. These supply shocks and the subsequent inflation are difficult for central banks. As Powell noted in his most recent press conference, the central banks’ tools are designed to reduce demand and don’t work as well against supply shocks.

They also have their own specific challenges. Powell left rates too low for too long, and excessive fiscal stimulus and the unknowns of a pandemic leave the Fed trying to balance the goal of catching up with current inflation reality while not choking off the recovery. Bailey’s challenges are even greater. Great Britain’s economy isn’t as strong as the U.S.’s. The pandemic was the second supply shock, as Brexit also unsettled supply chains. Britain also trades more with continental Europe, which is heavily affected by sanctions on Russian oil and uncertainty from Russia’s invasion of Ukraine.

When faced with so much uncertainty, investors should keep in mind things can and often do change. We expect rates to keep rising, but the Fed is “data-dependent.” If it looks like its actions are slowing the economy too much or, alternatively, not effective enough, it will change the pace of rate increases.

In periods of uncertainty, investors should also be data-dependent. The Fed has a mandate of keeping inflation and employment at the right levels. Your financial plan may also have a mandate of providing future spending for you and others. Daily fluctuations, like those experienced last week, can be unnerving, but don’t let them force you into changes when your plan is doing just fine.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504a.htm

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220504.pdf

https://www.bankofengland.co.uk/monetary-policy-report/2022/may-2022

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2022/may-2022

https://www.bls.gov/news.release/empsit.nr0.htm

Compliance Case #01361431