Stocks had a solid week, gaining nearly 5%. The jump was sparked by rumors on Friday that the Federal Reserve will raise rates by 75 basis points in November and then consider smaller hikes going forward. The market has priced in an extremely hawkish Fed, and any slight tilt to a more dovish stance could be a positive. Not to be outdone, the S&P 500 had been down the past five Fridays, as investors decided to sell ahead of the weekend. It’s good to see buyers stepping up ahead of the weekend, and the 2.4% bounce on Friday was welcome news.

- More signs point to another October low for stocks.

- Housing is in big trouble amid surging mortgage rates, but low supply may keep a floor on home prices.

- Industrial production data show manufacturing output continues to run strong.

- The economy probably expanded at a faster pace in the third quarter, with non-residential sectors offsetting the drag from housing.

Earnings are coming in better than expected, which is also helping stocks. In fact, according to FactSet, 20% of the S&P 500 has reported Q3 earnings — 72% beat expectations on earnings and 70% beat on revenue. The long-awaited massive recession will have to wait, as the economy again showed it’s on better footing than most give it credit.

Lastly, as noted in previous commentary, October has a reputation for being a bear market killer, with many bears ending in this most frightening month. 1974 and 2002 are the only years in recent history that were worse off nine months in than 2022. During those bear markets, stocks were nearly cut in half. But both bears ended in the first half of October. Stay tuned. We’re certainly open to October 2022 joining the club of bear market killers.

Housing Sector Feels the Brunt of Rate Hikes

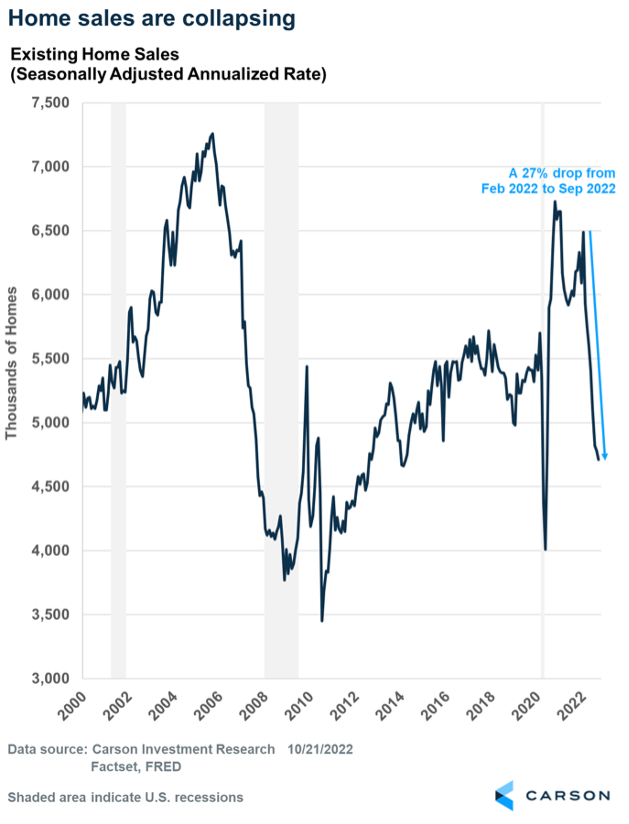

Predictably, the housing market is one of the first economic sectors to get hit, as has historically been the case, by the Fed raising rates. The 30-year fixed-rate mortgage was at 3.11% at the end of 2021. It’s now at 6.94%, the highest level since 2002! So, it’s no surprise that sales of existing homes have fallen for eight straight months through September for a cumulative decline of 27%.

And it doesn’t look like the bottom is in. Home prices surged almost 40% over the two years through July 2022 (using the Case-Shiller National Home Price Index). That’s great for homeowners but not great for anyone looking to buy a new home, especially after the surge in mortgage rates. The following chart shows how the average monthly mortgage payment has changed over time — using the median existing-home price, the prevailing 30-year mortgage rate, and assuming a 20% down payment. It’s more than doubled since January 2021! Affordability is falling at a record pace.

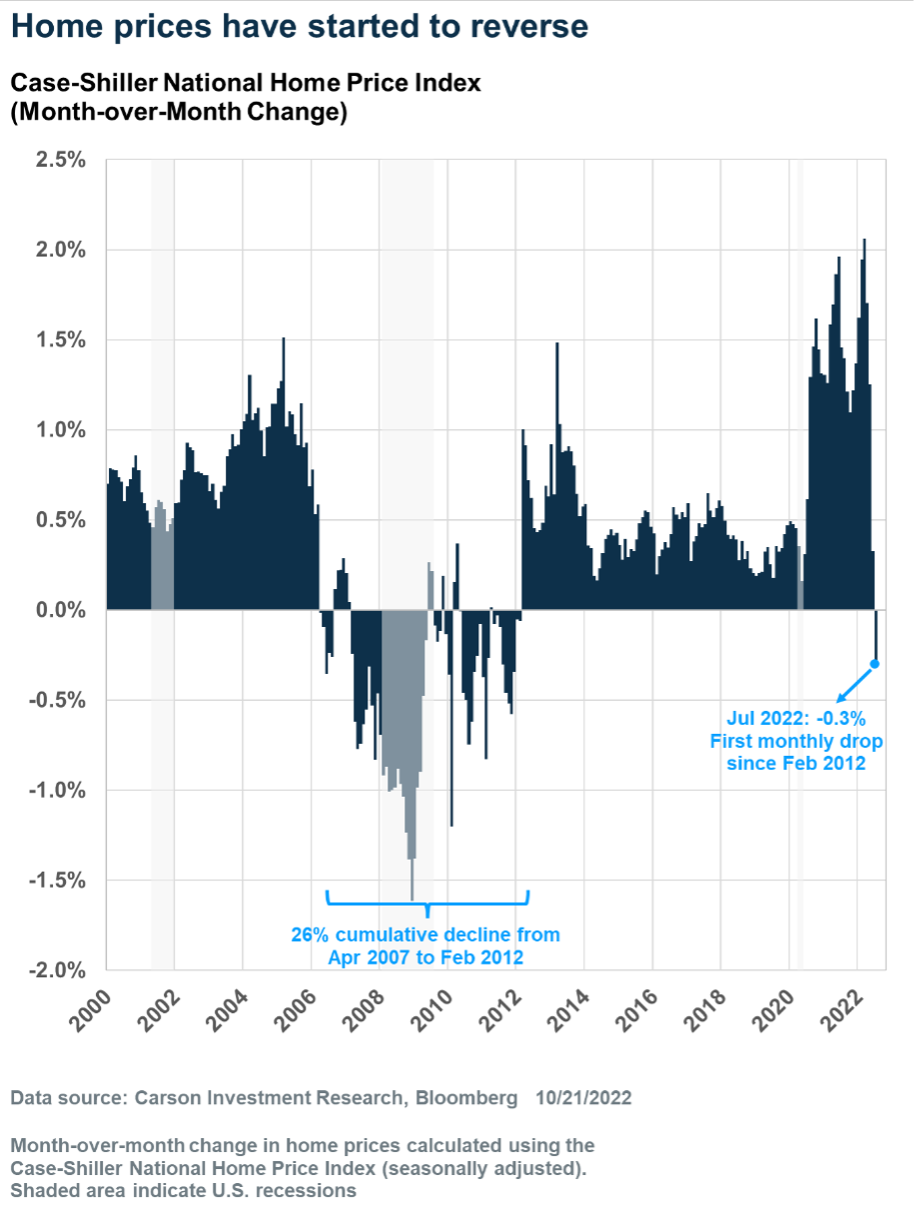

Home prices are responding to lower demand by moving lower. The Case-Shiller National Home Price Index fell 0.3% in July, its first monthly decline since February 2012. On a year-over-year basis, gains peaked at 21% in April and fell to 16% in July, which is still higher than at any point during the last housing bubble, when gains peaked around 14%. However, the deceleration is happening quickly.

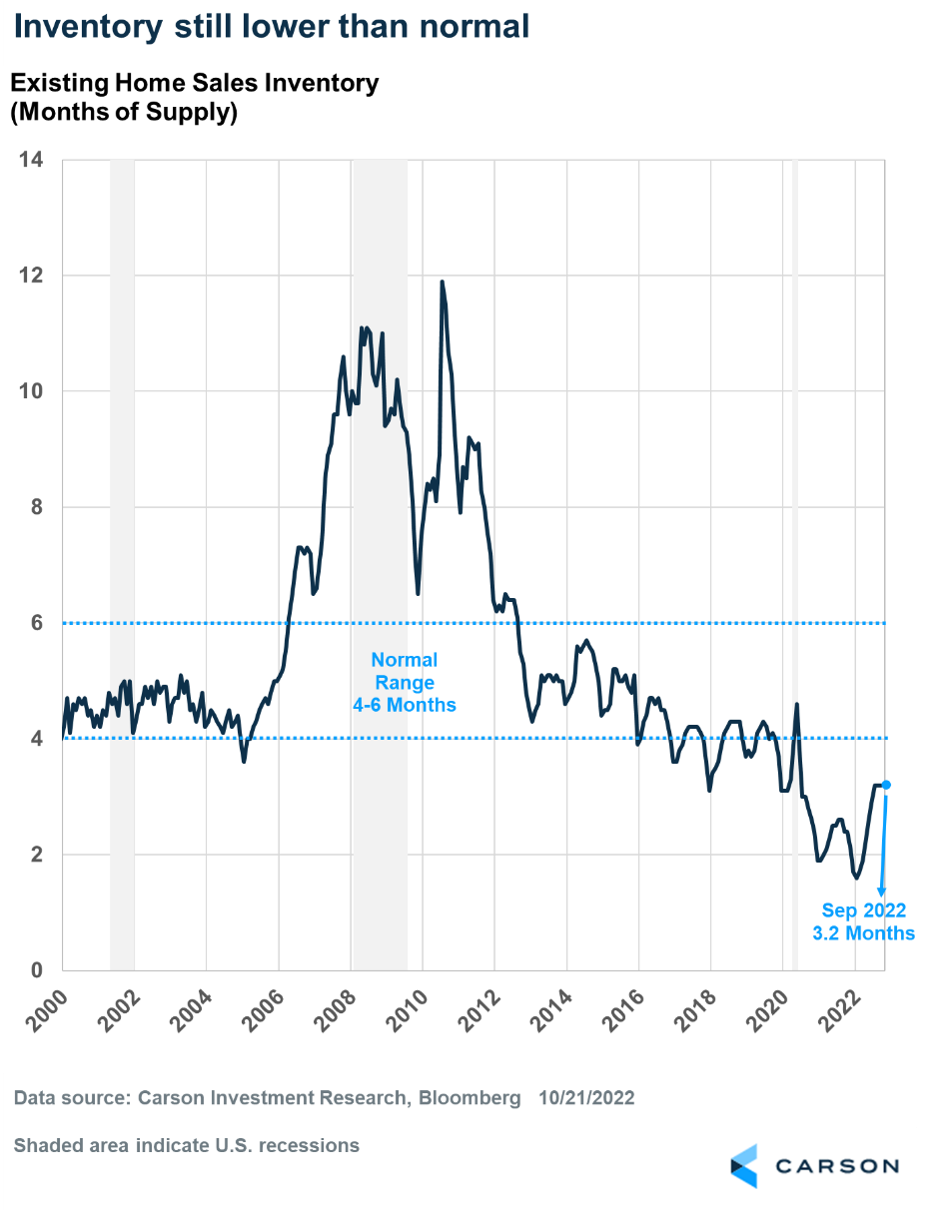

Normally, when demand falls, supply increases, which is what we saw during the 2007-2009 housing crash. That’s not happening now — at least, not yet. One measure of housing supply is “months-of-supply,” which is the number of months it will take to sell off the current inventory of homes if sales continue at the current pace. This metric is currently at 3.2 months. It hasn’t budged for three months now (July-September). It’s up from the record low of 1.6 months in January 2022 but still below what is considered normal, which is typically 4-6 months. Inventory matters for prices, as the next chart illustrates. Prices rise as inventory falls and, conversely, prices fall as inventory rises. Where we are on the chart (as of July) is unusual. Inventory is well below six months of supply and prices are falling. Something’s got to give — either home prices don’t fall significantly, or inventory rises.

So, the big question is whether inventory will rise. For one thing, there’s not a lot of new supply coming. Single-family housing starts collapsed by 26% this year (through September) as builders pulled back amid rising rates and falling demand. Building permits for single-family homes, which leads starts, fell 22% over the first nine months of the year.

Another way for inventory to rise is if distressed sales start flooding the market, which is what happened in 2007-2009 when inventory surged to more than 11 months of supply, even as starts crashed. But there’s not a lot of distress now, at least not yet. There are three significant reasons for this:

- The quality of mortgage applicants has been much higher in this cycle than in the 2000s. Prior to 2008, less than a quarter of applicants had credit scores above 760, while more than half were below 720. Lending standards tightened considerably after the crash, and over the past decade, especially over the past few years, most borrowers had credit scores of 760+.

- Mortgage rates are rising, but there aren’t many borrowers with adjustable-rate mortgages (ARMs) this time around. The share of ARMs averaged about 6% from 2012-2019 and around 3% from 2020-2021, a huge contrast to the significant share of ARMs in the 2000s (it peaked around 36% in 2005). This became a problem in the last cycle when rates reset higher and borrowers couldn’t afford payments, leading to a wave of distressed selling. It’s going to be significantly less of an issue this time around.

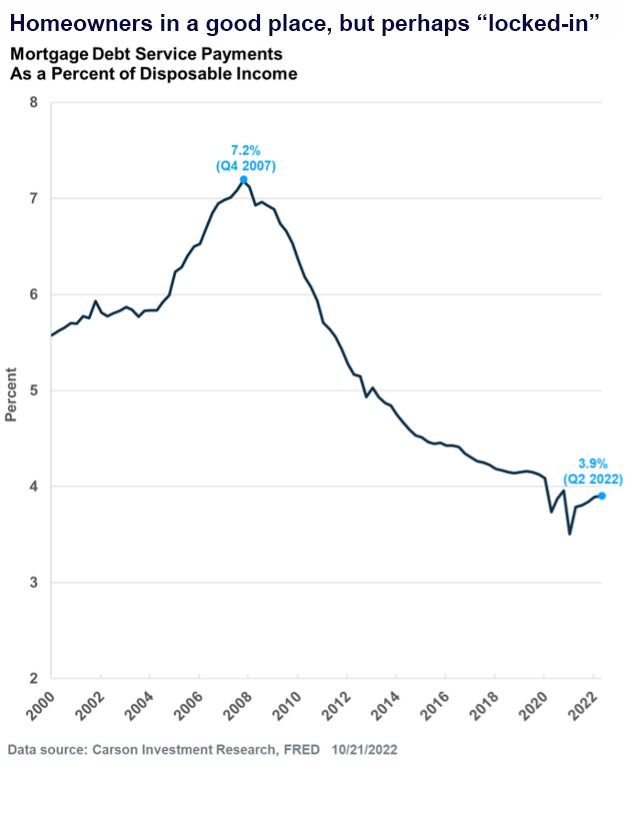

- Affordability is falling for new homebuyers, but existing homeowners are in a good place with respect to their mortgage payments, especially considering that many refinanced amid record low mortgage rates and also saw their incomes rise. Mortgage debt service payments as a percent of disposable income was at 3.9% as of the second quarter of 2022, only slightly higher than the record low of 3.5% from the first quarter of 2021.

The downside is homeowners are locked into their homes, making them reluctant to sell, especially in the face of rising mortgage rates and falling prices. These homeowners are also likely to have a lot of equity in their homes, thanks to the price surge over the past two years. So, they may be more likely to tap into that equity and renovate to make their homes fit growing needs, rather than sell and find a new house. Of course, some homeowners simply have to sell, whether to relocate for a job or be closer to family.

Clearly, there’s a lot of downward pressure on supply. It’s likely prices will continue to fall, especially given the run-up over the last couple of years. The caveat is it will be markedly different across various locations. Yet, the supply picture may put a floor on how low prices will go in this cycle, and the last housing crash may not be repeated. In any case, inventory will be key to watch.

Other Sectors are Overcoming the Housing Drag

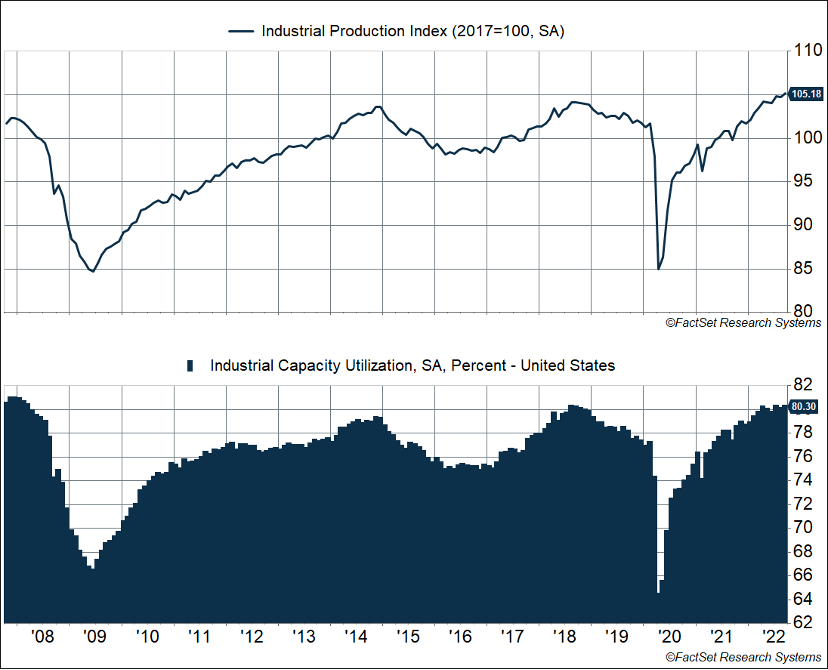

The good news, so far, is other sectors of the economy are overcoming the economic drag from housing. Within housing itself, multi-family housing remains a bright spot, with construction of multi-family units at their highest levels since 1974. Industrial production data released last week showed manufacturing output rose 0.4% in September, the third straight month of strong gains. Much is on the back of rebounding auto production, but output for other durables, and even non-durables, is also running strong. Capacity utilization also hit 80.3%, matching its highest level over the past decade.

GDP growth for the third quarter will be reported this week, and economic growth is expected to rebound from a weak first half. The drag from residential investment will probably be more than offset by a smaller trade deficit (more exports, fewer imports), strong services consumption, and more non-residential investment.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ 100 Index is a stock index of the 100 largest companies by market capitalization traded on NASDAQ Stock Market. The NASDAQ 100 Index includes publicly-traded companies from most sectors in the global economy, the major exception being financial services.

Compliance Case # 01526808