2022 has been historically difficult for investors so far, and it’s likely you have questions. We’re here to answer some of the most common questions we’re hearing nowadays.

Feel free to talk with your advisor about any of these topics – or if you have other questions not addressed here.

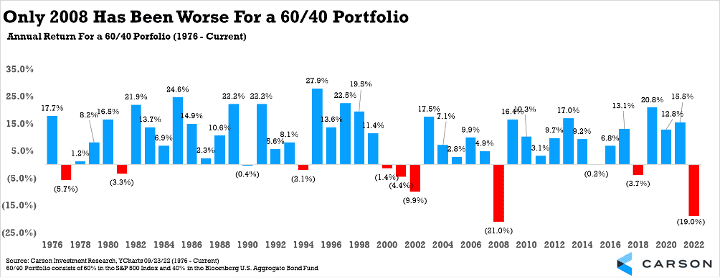

1) Just how bad has this year been?

There’s no way to sugar coat things – 2022 has been a rough year. Bonds historically have done well when stocks don’t, but this year that isn’t happening. In fact, the five previous times the S&P 500 lost 10% or more for the year, bonds (as measured by the Bloomberg U.S. Aggregate Bond Index) gained every time, up 7.7% on average.

With the S&P 500 price index down 22.5% for the year and bonds down 13.8%, only 2008 was a worse year for a 60/40 portfolio (with 60% in stocks and 40% in bonds).

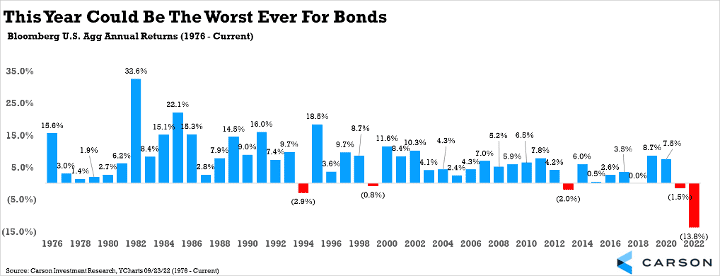

2) My bonds are down a lot. How bad has it been?

Yields have soared this year on higher inflation expectations and a hawkish Federal Reserve. As a result, bonds have been performing poorly.. Yields and bond prices historically trade inversely.

The Bloomberg U.S. Aggregate Bond Index is currently down nearly 14% for the year, far and away the worst year historically (since 1976). To put things in perspective, it had never been down two years in a row (which will likely happen this year) and the previous worst year was a 2.9% drop in 1994.

3) Why shouldn’t I just sell everything right now?

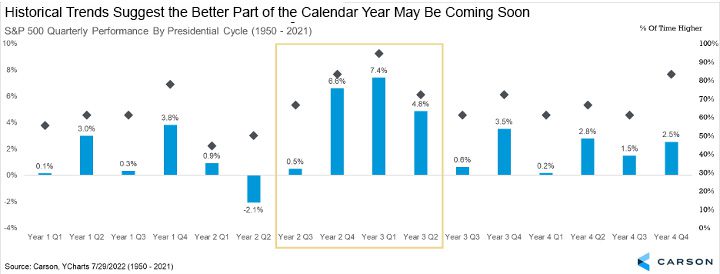

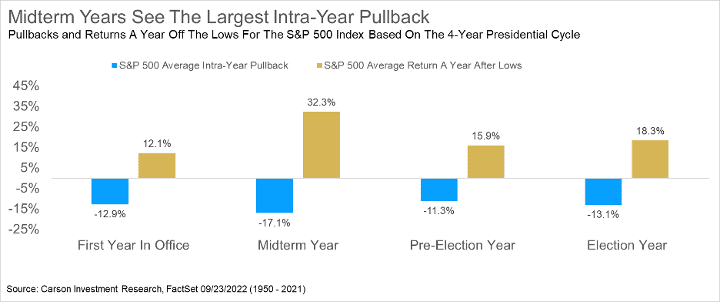

Stocks historically haven’t done very well the first few quarters of a midterm year, but they do quite well once the midterm election is over. In fact, since World War II, the S&P 500 has been higher a year after the midterm election every single time, up 14.1% on average. Much better times could be coming – and soon.

One final reason to remain optimistic and not sell now is that data shows stocks have historically tended to perform well after a midterm year low. Since 1950, the S&P 500 has gained more than 32% on average off the lows and has never been lower a year later. The June lows are not far away from current levels. Should new lows be made, it could be another positive for investors going out a year or more.

4) Should we have seen this trouble coming?

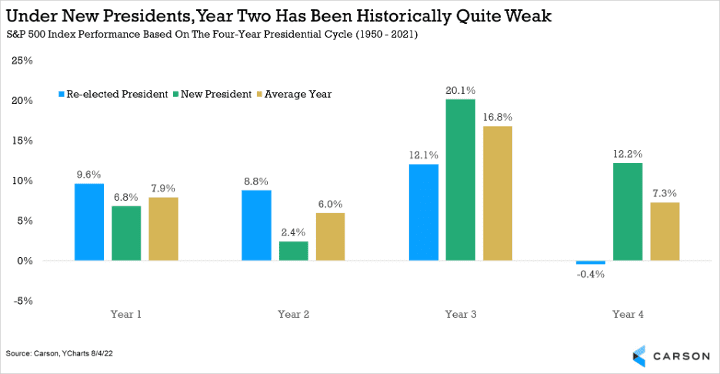

Although the size of the drop in stocks and bonds is surprising, to see some weakness this year wasn’t overly surprising. Some of the worst quarters of the four-year cycle took place during this year. The second year (so this year) under a new President tends to be quite weak as well. The good news is how well stocks historically do the following year under a new President.

5) What should we do now that stocks are in a bear market?

There’s an old saying that the stock market is the only place where when things go on sale, everyone runs out of the store screaming. Things are no doubt on sale and investors with a long enough investment horizon may want to look at this weakness as a potential opportunity.

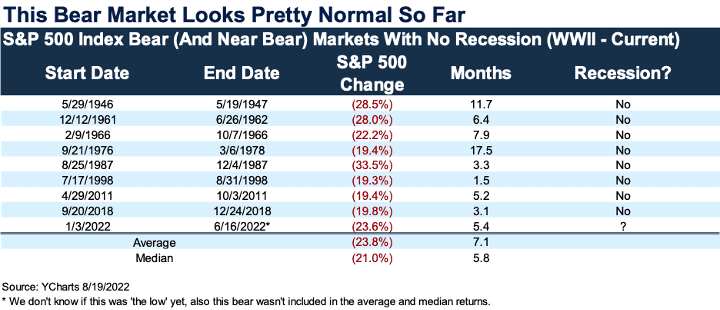

We continue to think the economy isn’t in a recession (more on this below), so that likely means stocks won’t fall significantly from here. Historically, the bear markets that took place without a recession showed stocks falling about 24% on average. In fact, only once did stocks fall more than 30% without a recession and that was the 1987 crash. More near-term pain is always possible, but a major low could be quite near.

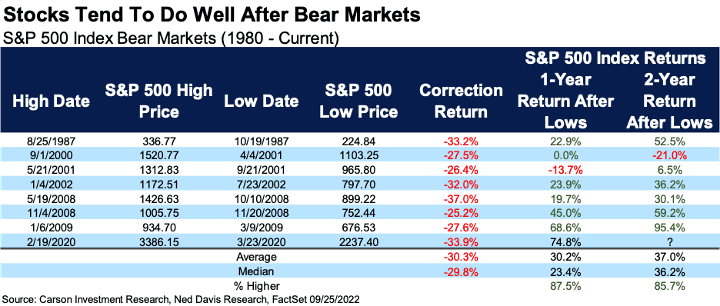

6) What could happen once the bear market is over?

No one knows when this current bear will end (we do think it will be fairly soon), but you should be open to significant gains coming off the bear lows.

7) Is the Fed going to break something? Or when will they stop hiking?

The Fed has made it very clear that they would be okay with some pain (think a mild recession) to put a lid on inflation. There is no easy answer here, but Chairman Powell knows history and knows that the Fed didn’t increase rates enough or keep them high for long enough in the 1970s, which led to massive inflation in the late ‘70s and early ‘80s. The truth is the Fed might break something and that might be part of their plan.

Looking back at the previous eight rate hike cycles shows that the Fed hikes until rates get above the headline CPI number. With inflation still running at 8.3% and rates at 3.25%, more hikes could be in the cards. And the Fed’s latest projections suggest we’ll see at least another 125–150 basis points of rate hikes.

8) Will inflation ever come back down?

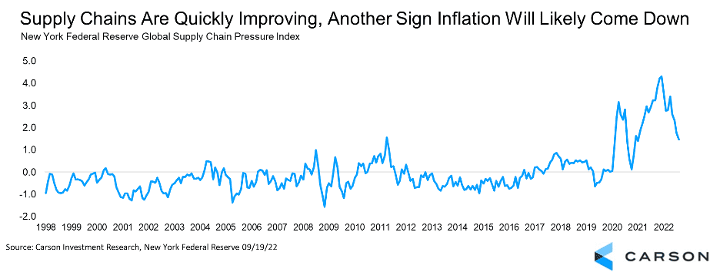

The recent CPI number was disappointing, showing prices for many goods and services at the consumer level were increasing more than expected. The good news is various other inflation measures are coming back, and quickly, in many cases. For starters, energy prices have fallen and in many cases are lower than before the war started – a good sign. Meanwhile, supply chains are improving, as this survey by the NY Fed shows.

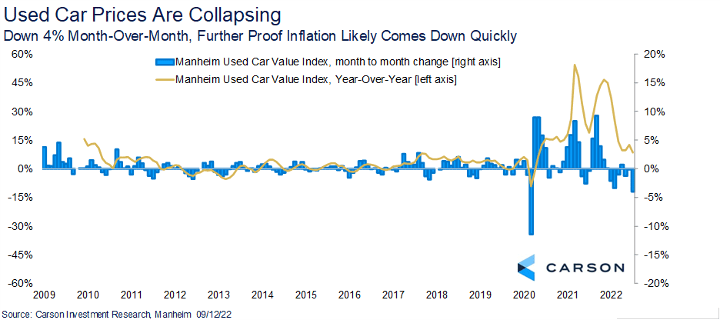

One of the main reasons we are optimistic that inflation could be about to come down quickly is used car prices are rapidly dropping. The recent Manheim Used Car Value Index fell 4% last month, which is one of the largest drops ever. Used cars make up a large part of inflation readings and this should provide a nice tailwind going forward.

9) Aren’t we in a recession right now?

The odds of a recession in 2023 have unquestionably gone up, as the Fed continues to hike rates. But currently, we do not see the economy in a recession. The main reason is the employment backdrop is so strong. More than 3.5 million jobs have been created this year, one of the most ever and not at all recessionary. Additionally, industrial production has been very strong, another important component to the economy. Even consumer spending has remained stubbornly strong amid all the concerns.

Now, there are obvious worries as consumer confidence has been very low (but has been improving with gas prices falling) while manufacturing has slowed, and housing data is tanking due to higher mortgage rates. Currently, we think this is more of a midcycle slowdown versus the start of a recession.

10) What could happen after the midterm elections?

One thing we try to stress on the Carson Investment Research team is not to mix your politics with investing. Many investors didn’t like President Obama and missed out of significant gains, while others didn’t like President Trump and missed out on gains.

Turning to the midterms, we know the party that lost the prior Presidential election is the motivated party and they tend to gain four seats in the Senate and nearly 30 seats in the House. Should this pattern hold again, and the Republicans take both chambers of Congress, this is the very best scenario for stocks. A Democratic President and Republican-controlled Congress has seen the S&P 500 gain more than 16%, on average, during the calendar year. In fact, we saw this in the late 1990s under President Clinton.

What if the Democrats keep control of the Senate? This is about a coin flip by the odds makers and the good news is a Democratic President with a split Congress is also a bullish scenario.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Bloomberg

U.S. Aggregate Bond Index” formerly known as the “Barclays Capital U.S. Aggregate Bond Index”, and prior to that, “Lehman Aggregate Bond Index,” is a broad-based flagship benchmark that measures the investment grade, US dollardenominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed rate pass-throughs), ABS and CMBS (agency and non-agency).